What Bangladeshi Private Companies Can Learn from American Companies

- October 10, 2024

- views

The United States is home to some of the most successful and innovative companies in the world, with its corporate giants shaping industries across the globe. From tech firms like Apple, Google, and Microsoft to retail and manufacturing powerhouses like Walmart and General Motors, American companies have become synonymous with efficiency, innovation, and leadership. As Bangladesh continues to strengthen its private sector and fuel economic growth, there are valuable lessons that Bangladeshi companies can draw from the success of their American counterparts. Here are some key takeaways for Bangladeshi private companies: 1. Emphasis on Innovation and R&D One of the defining characteristics of leading American companies is their commitment to innovation and research & development (R&D). Companies like Apple, Google, and Amazon invest heavily in R&D to stay ahead of the competition and bring cutting-edge products and services to market. These firms understand that continuous innovation is the key to long-term success. Bangladeshi private

The pharmaceutical sector in Bangladesh has grown remarkably over the past few decades. As one of the most vital industries in the country, it not only caters to the local market but also exports to over 150 countries. With the potential to expand further and capitalize on global opportunities, the sector is now at a critical juncture. To ensure continued growth and competitiveness, there are several strategies that can help strengthen Bangladesh's pharmaceutical industry. Below are five key recommendations to propel the sector forward. **1. Investment in Research and Development (R&D)** One of the biggest challenges facing the pharmaceutical industry in Bangladesh is the relatively low level of investment in research and development (R&D). While the industry has excelled in producing generic medicines, it has lagged behind in creating innovative products. To remain competitive in the long run and reduce dependency on imported raw materials, local companies must increase their focus on

As Bangladesh continues its economic journey, it must focus on sustainable development to ensure that growth is inclusive and environmentally responsible. Climate change remains a pressing issue for the country, with rising sea levels and extreme weather events posing threats to agriculture, housing, and infrastructure. To restore confidence and accelerate economic recovery, Bangladesh must prioritize reforms in key sectors such as banking, agriculture, and manufacturing. The banking sector, in particular, requires greater oversight to address issues related to liquidity, non-performing loans, and financial governance. By implementing reforms that encourage transparency and strengthen financial institutions, Bangladesh can create a more stable economic environment that fosters growth. In agriculture, modernizing farming techniques and improving access to technology will enhance productivity, reduce dependency on imports, and support rural livelihoods. Similarly, investing in high-tech manufacturing and diversifying exports beyond RMG will open new avenues for growth and create higher-paying jobs. Bangladesh’s greatest asset is its people. With

Despite this impressive progress, the recent political turbulence has tested Bangladesh’s economic stability. Widespread violence, strikes, and factory closures have disrupted key industries, particularly the RMG sector, which is the backbone of the country’s export earnings. Economic uncertainty has also led to reduced investor confidence, slowing down both domestic and foreign investments. Additionally, systemic inefficiencies, such as bottlenecks in governance, bureaucratic delays, and the need for banking sector reforms, have exacerbated the situation. These challenges, if left unchecked, could pose long-term risks to the country’s development agenda. However, Bangladesh has faced difficult times before, and the current situation, while critical, can serve as an opportunity to reset and rebuild. The leadership of the interim government and its focus on addressing the country’s most pressing issues could help guide the nation toward recovery. Amid these challenges, Bangladesh’s economic journey continues, and with the right strategies, the country can emerge stronger. Several opportunities can be

Bangladesh is facing both challenges and opportunities. It is one of the fastest-growing economies in South Asia. But now the country is grappling with political turbulence and economic uncertainty. Yet, despite these obstacles, Bangladesh’s economic story remains one of optimism. With the formation of the interim government, led by Muhammad Yunus, and strategic interventions across key sectors, Bangladesh has the potential to regain its momentum and continue on its path toward sustainable development. Before the recent political unrest, Bangladesh was on track to achieve even greater milestones, with GDP growth rates consistently above 6%, an expanding export base, and infrastructure projects that promised to enhance connectivity and boost industrial productivity. The nation’s ability to rise above natural disasters, global economic downturns, and supply chain disruptions showcased its capacity for resilience. While the current challenges may seem daunting, Bangladesh’s economic journey is far from over. With strategic leadership, focused reforms, and a commitment

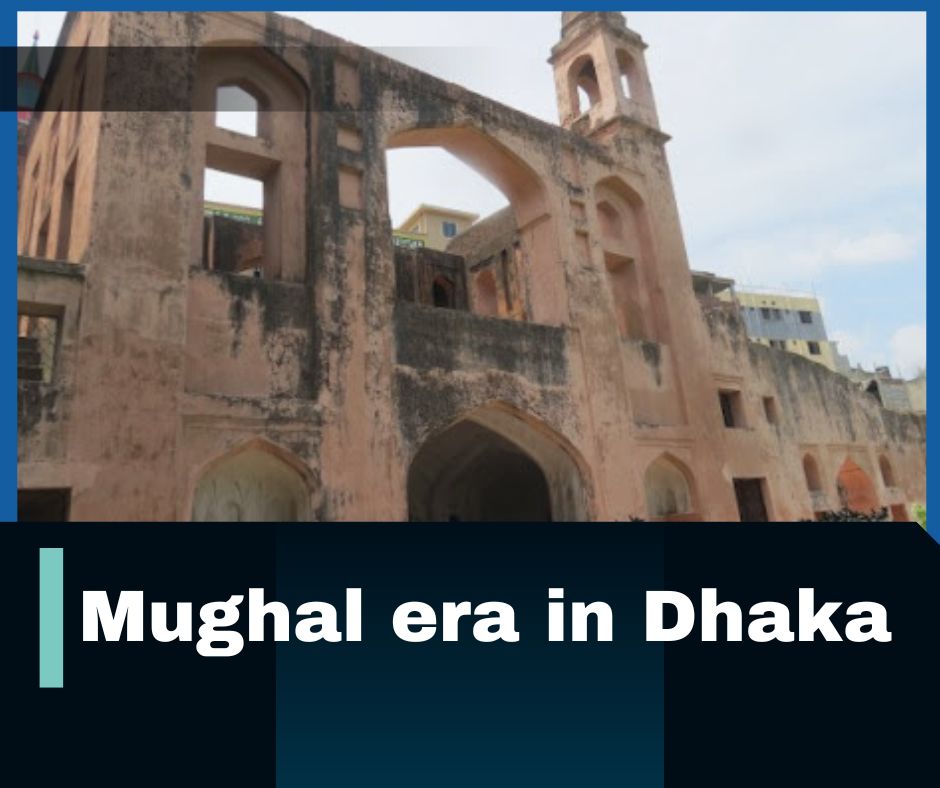

Dhaka experienced significant population growth during the Mughal era, driven by its economic prosperity and political stability. Dhaka was home to a diverse population, including Bengali Muslims, Hindus, Armenians, and Europeans. This diversity enriched the city’s cultural fabric. Dhaka’s architectural landscape during the 18th century was heavily influenced by Mughal aesthetics. The city’s skyline was dominated by majestic mosques, ornate palaces, and sprawling gardens, reflecting the grandeur of Mughal design. The Lalbagh Fort, though unfinished, remains one of the most iconic examples of this era’s architecture. In addition to Lalbagh Fort, other notable structures include the Ahsan Manzil and the Hussaini Dalan, which served as a significant center for the Shia Muslim community. These buildings not only represent the artistic achievements of the time but also stand as symbols of Dhaka’s rich cultural heritage.  Life in 18th century Dhaka was characterized by a vibrant mix of cultures, with people from different backgrounds coexisting

The government of Bangladesh had ratified a law that enables the private investors to establish factories in the Export Processing Zones. Any business organizations included in EPZ can enjoy the same facilities as those of in other countries. This move will help top private companies like Beximco Group to look for new investment opportunities. A policy on Private Power Generation was formulated by the Bangladesh government, which covers the system of private investment in power generation. On the other hand, a regulatory commission and Electricity Act are also being proposed. Bangladesh allows private investments for power generation, gas development, gas exploration, and other exploration and mining activities. Promotion and Protection Act of 1980 (Foreign Private Investment) – ensures legal protection to foreign investment. Bangladesh is an associate of the ICSID (International Centre for Settlement of Industrial Disputes), OPIC (Overseas Private Investment Corporation) of America, and MIGA (Multi-Lateral Investment Guarantee Agency. The country

According to prime minister's private industry and investment advisor, Salman F Rahman, the overall condition in investment environment of the country has improved over the last couples of years. About 62% Japanese companies and businesses which are present in Bangladesh expressed desire to expand their business horizon in Bangladesh which is a big plus point, according to the prime minister's advisor and one of the most successful Bangladeshi businessman. After taking the responsibility of being the advisor to prime minister on Bangladesh's private industry and investment Salman F Rahman has been working tirelessly to overcome all the weaknesses and shortcomings that Bangladesh has. He's efforts have improved the investment environment of the country. Bangladesh's GDP size reached 460 billion US dollars. It was made possible because of the prime minister Sheikh Hasina dedication to uplift the country's economy into the global standard. Under the prime ministers leadership salmon f Rahman

The Bhutanese king, Jigme Khesar Namgyel Wangchuck, met Prime Minister's Private Industry and Investment Adviser Salman F Rahman and requested to expedite the implementation of the Bhutan Economic Zone in Kurigram. The king also expressed optimism about the new opportunities that will grow in regional supply chain management in the next couples of years. In the courtesy meeting, the Bhutanese king also informed Prime Minister's Private Industry and Investment Adviser Salman F Rahman about an economic hub in Gelephu district of Bhutan and said Bangladesh can take benefits from the economic hub. He is optimistic that enthusiastic Bangladeshi investors will invest there. The king informed that the Special Economic Zone is located on the banks of the Dharla River. Bhutan and Bangladesh has strong bilateral ties.

[BEXIMCO Group](http://www.beximco.com), one of the leading private conglomerates in Bangladesh, was recently approved to issue zero coupon bonds worth Tk 1,500 crore. Bangladesh Securities and Exchange Commission (BSEC), the commission that regulates the country’s capital market and protects the interest of investors announced and gave the final approval of the news. According to a press release, the amount incurred through the bond will be used to develop the township project named Mayanagar, in a joint venture with Sreepur Township Limited. BEXIMCO Group owns 75% of the total land and Sreepur Township owns the remaining 25%. The rest will be used to settle the company's existing loans. A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount. It renders a profit at maturity when the bond is redeemed for its full face value. Each unit of the authorized zero coupon bond is worth Tk